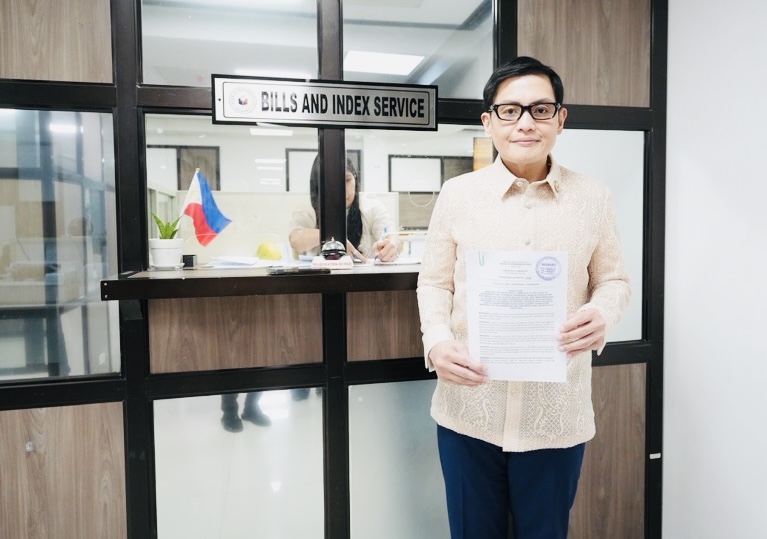

DEPUTY Speaker Jefferson F. Khonghun on Tuesday filed a House resolution directing the appropriate committee of the House of Representatives to conduct a comprehensive inquiry, in aid of legislation, into reports of the misuse, abuse, and alleged “weaponization” of Letters of Authority (LOAs) and Mission Orders (MOs) by officials and personnel of the Bureau of Internal Revenue (BIR).

The resolution seeks to strengthen safeguards against corruption, ensure fair and transparent tax administration, and protect the constitutional rights of taxpayers from harassment and extortion.

Deputy Speaker Khonghun emphasized that while the BIR plays a critical role in collecting revenues essential to national development, recent whistleblower testimonies, investigative reports, and taxpayer complaints point to serious irregularities in how LOAs and MOs are being used.

Although the Senate has initiated hearings into these allegations, the Deputy Speaker believes that it is imperative for the House of Representatives to exercise its own oversight and legislative function to ensure comprehensive reforms are enacted.

“Taxpayers have come forward with credible accounts of inflated assessments that are later negotiated down through unofficial ‘packages,’ clandestine payments via drop boxes, instructions to falsify receipts, and even threats of retaliation or blacklisting for those who resist or expose these practices,” said Deputy Speaker Khonghun. “Reports even suggest that up to 70% of collections tied to certain LOA audits may be diverted to private pockets instead of going to the National Treasury. This is not tax enforcement—it is extortion disguised as enforcement.”

The Representative of the 1st District of Zambales noted that these alleged practices erode public trust, undermine investor confidence, and distort the business environment at a time when the country is working to attract sustainable investments.

The resolution recognizes key BIR reforms and developments including : The BIR’s suspension of audit operations in late 2025 through Revenue Memorandum Circular (RMC) No. 107-2025, which acknowledged issues such as fake LOAs, unauthorized audits, and inconsistent practices. The recent introduction of the LOA Verifier under RMC No. 5-2026, intended to allow taxpayers to authenticate LOAs online via the BIR’s Chatbot.

Although, the Deputy Speaker believes that these are not enough to dismantle deeply entrenched extortion rackets targeting taxpayers and businesses. “We need a comprehensive review of audit protocols, issuance procedures, the real impact of recent reforms, and stronger legislative and administrative protections for honest taxpayers,” he added.

The proposed inquiry aims to:

1. Review the integrity of current LOA and MO issuance and audit protocols

2. Assess the effectiveness of the audit suspension and the new LOA Verifier system

3. Propose concrete safeguards to prevent harassment, extortion, and abuse of authority

4. Recommend stronger penalties, accountability mechanisms, and structural reforms to restore confidence in the Philippine tax system

Deputy Speaker Khonghun stressed that the House of Representatives must fulfill its constitutional duty to conduct independent oversight and craft the necessary legislative measures.

“Every Filipino—whether a small business owner or a large investor—deserves a tax system that collects what is due to the State without becoming a tool for personal enrichment or intimidation. We owe it to our people to act decisively,” he concluded.